Decoding the Audit Landscape

Understanding the difference between internal audit vs external audit is crucial for strong organizational governance. This listicle clarifies six key distinctions between these audit types, empowering you to improve risk management and financial transparency. Learn how their objectives, scope, timing, and reporting vary, and how each contributes to organizational success. This comparison covers independence, purpose, regulatory requirements, frequency, costs, and stakeholder communication. Let's explore these differences.

1. Independence and Objectivity Differences

A cornerstone of the "internal audit vs external audit" discussion revolves around independence and objectivity. This fundamental difference shapes the scope, perspective, and ultimately, the credibility of audit findings. Understanding this distinction is crucial for anyone involved in financial oversight, from internal audit teams and external audit professionals to finance and accounting departments, audit managers, compliance officers, and even those working with data in Excel who need to understand the implications of audit findings. This critical difference directly influences how audit results are perceived and acted upon.

Internal auditors, as employees of the organization, report to senior management or the audit committee. Their inherent connection to the organization provides them with deep organizational knowledge, allowing them to navigate complex internal structures and processes with ease. They can conduct continuous monitoring, offering ongoing insights into the organization’s operations. However, this close relationship can create potential bias, influencing their judgment and potentially compromising the objectivity of their findings. This potential for bias can also affect how stakeholders perceive the audit's results, potentially leading to questions about its credibility.

External auditors, on the other hand, are independent third parties contracted by the organization to provide an unbiased assessment. Their independence ensures objectivity, providing assurance to stakeholders, including regulatory bodies and investors, that the audit is free from internal influence. This independence is crucial for regulatory compliance, bolstering public trust in the financial reporting of the organization. However, external auditors often have limited organizational context, requiring more time to understand internal nuances and complexities. Their engagement is typically periodic rather than continuous, providing snapshots of the organization's control environment at specific points in time, rather than ongoing monitoring.

The differing reporting relationships also influence the scope and focus of each audit type. Internal audits can be tailored to the specific needs of management, addressing operational efficiency, risk management, and internal control effectiveness. External audits, primarily focused on financial reporting, aim to provide reasonable assurance that the financial statements are free from material misstatements. This difference in focus affects the level of access to sensitive information granted to each type of auditor. Internal auditors typically have broader access due to their ongoing involvement in organizational operations, while external auditors’ access is generally limited to information relevant to the financial statement audit.

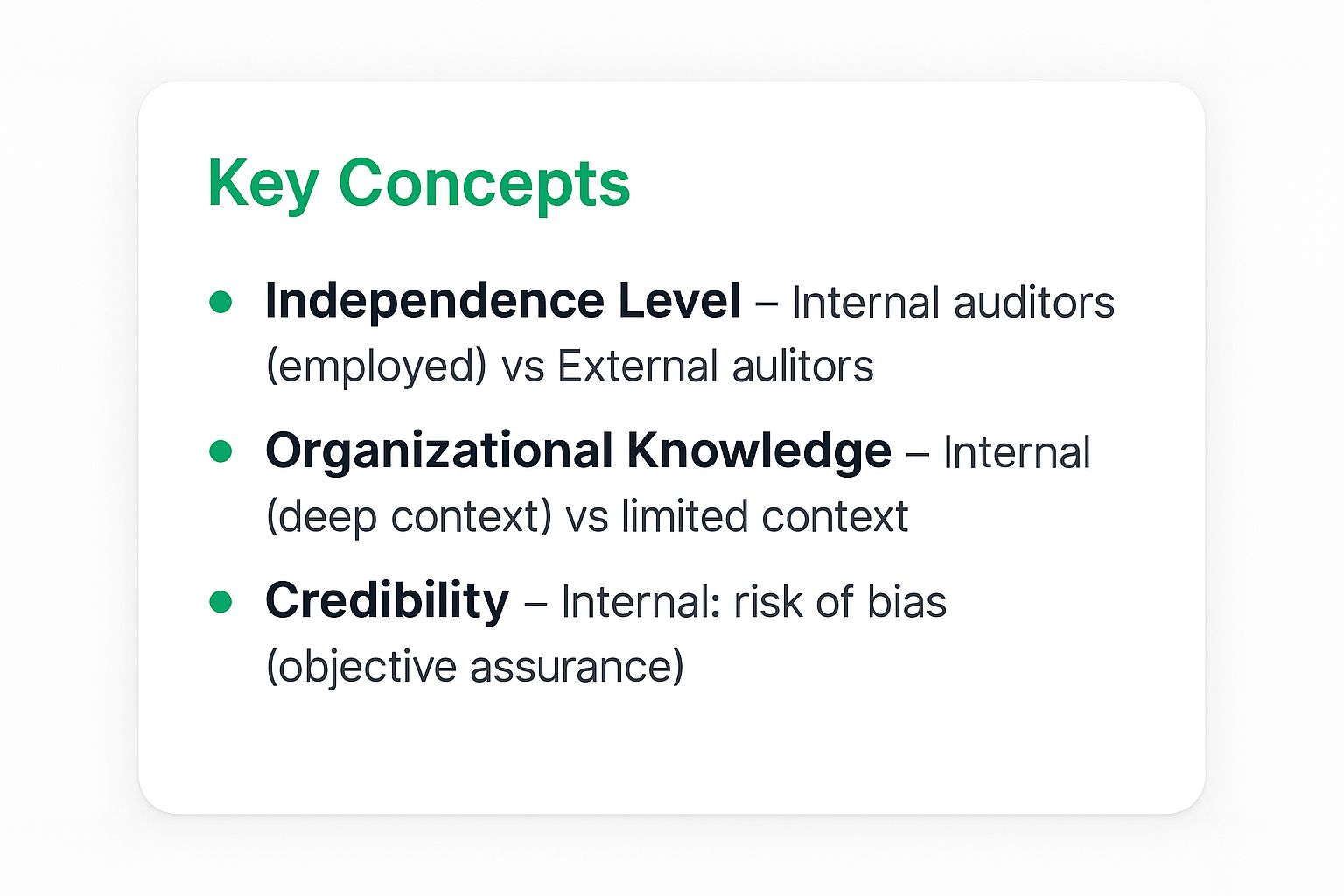

The following infographic summarizes these key distinctions between internal and external auditors:

As the infographic highlights, the core differences lie in independence, organizational knowledge, and resulting credibility. These factors are crucial when considering which type of audit is best suited for a particular need.

Real-world examples highlight the critical importance of understanding the strengths and weaknesses of both internal and external audits. The Enron scandal underscored the catastrophic consequences of compromised external auditor independence. Conversely, JPMorgan Chase’s internal audit function played a role in identifying the “London Whale” trading losses, demonstrating the value of continuous monitoring and deep organizational knowledge. However, the Wells Fargo fake accounts scandal showcased the dangers of internal audit failures, further emphasizing the need for robust independence protocols and direct reporting lines to audit committees.

<iframe width="560" height="315" src="https://www.youtube.com/embed/NCxkS06y2MY" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen></iframe>This video further explores the nuances of internal and external audits, offering valuable insights into their distinct roles and responsibilities.

To maximize the effectiveness of both internal and external audits, organizations should consider the following actionable tips:

- Establish clear independence protocols for internal audit functions. This includes direct reporting lines to the audit committee and policies that prevent conflicts of interest.

- Ensure external auditors rotate partners regularly. This practice helps maintain independence and a fresh perspective.

- Create direct reporting lines to audit committees for both internal and external audit functions. This ensures transparency and strengthens oversight.

- Implement policies preventing conflicts of interest for internal auditors. This might include restrictions on auditing departments where they have previously worked or have close personal relationships.

By understanding the inherent differences between internal and external audits, organizations can leverage the strengths of each to enhance their governance, risk management, and control processes. This understanding is crucial not only for audit professionals but also for anyone involved in financial oversight and decision-making.

2. Scope and Purpose Variations

A core distinction between internal and external audits lies in their respective scopes and purposes. Understanding these differences is crucial for organizations to effectively leverage both audit functions and gain comprehensive assurance. While both contribute to a robust control environment, they operate with distinct objectives and methodologies, targeting different stakeholders and ultimately providing unique value propositions. Choosing the right audit function, or a combination of both, depends heavily on the specific needs and objectives of the organization. This section delves into the key variations between internal and external audit scopes and purposes.

Internal audits, conducted by an organization's own employees or contracted professionals, primarily serve to enhance operational efficiency, strengthen risk management processes, and evaluate the effectiveness of internal controls across all business processes. They adopt a holistic view of the organization, examining a wide range of activities including finance, operations, compliance, and IT. This broad scope enables internal auditors to identify potential weaknesses and recommend improvements across diverse areas, contributing to continuous improvement and value creation. For example, an internal audit might assess the efficiency of a manufacturing process, the effectiveness of cybersecurity protocols, or the compliance with internal policies related to data privacy.

External audits, on the other hand, are performed by independent certified public accountants (CPAs). Their primary focus is on verifying the accuracy and fairness of an organization's financial statements. They work to ensure that these statements comply with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) and provide a true and fair view of the company's financial position. This information is crucial for external stakeholders, such as investors, lenders, and regulators, who rely on these audited financial statements to make informed decisions.

Several key features distinguish these two audit types. Internal audits cover operational, compliance, and strategic areas, contributing to overall organizational effectiveness. External audits primarily focus on financial reporting accuracy and regulatory compliance. The risk assessment approaches also vary. Internal auditors consider a broader range of risks, including operational, reputational, and strategic risks, while external auditors primarily focus on risks related to financial statement misstatements. Furthermore, the materiality thresholds differ, with external audits typically setting higher thresholds due to their focus on significant financial impacts. The frequency and depth of examination also vary, with internal audits often conducted more frequently and covering specific areas in greater detail, while external audits are typically annual events with a broader, but less detailed, scope.

Each approach has its inherent advantages and disadvantages. Internal audits offer comprehensive operational coverage, fostering a culture of continuous improvement. They provide management with valuable insights into operational efficiencies and control weaknesses, leading to process optimization and cost savings. External audits provide standardized financial verification and assurance of regulatory compliance, enhancing stakeholder confidence and supporting access to capital markets.

However, internal audits may lack standardization across industries, potentially leading to inconsistencies in approach and reporting. External audits, while providing crucial assurance on financial reporting, have a limited scope beyond financial matters and offer a snapshot-in-time perspective, potentially missing emerging risks or ongoing operational issues.

Illustrative examples demonstrate these differences. Microsoft's internal audit team covers areas like cybersecurity, compliance, and operational efficiency across its diverse business segments. In contrast, PwC's external audit of Apple focuses on verifying the accuracy of Apple's financial statements and their compliance with GAAP. A successful example of internal audit's impact can be seen in General Electric's internal audit identifying operational inefficiencies that resulted in millions of dollars in savings.

To optimize the benefits of both internal and external audits, organizations should align their internal audit scope with their overall risk appetite. Coordination between internal and external audit teams is essential to avoid duplication of effort and maximize efficiency. A risk-based audit planning approach for both functions ensures that resources are allocated to the most critical areas. Finally, clearly documenting scope limitations in audit reports promotes transparency and manages stakeholder expectations. Learn more about Scope and Purpose Variations can provide additional insights into these concepts. By understanding these nuances, organizations can effectively leverage both internal and external audits to strengthen their control environment and achieve their strategic objectives.

3. Regulatory Requirements and Standards

A critical differentiator between internal and external audits lies in the regulatory requirements and standards governing each. These frameworks shape the objectives, methodologies, and reporting of both audit types, impacting their respective roles in ensuring organizational accountability and financial integrity. Understanding these distinct requirements is crucial for navigating the complexities of corporate governance and compliance.

External audits are primarily driven by legally mandated compliance, particularly for publicly traded companies. Legislation like the Sarbanes-Oxley Act (SOX) in the United States mandates independent external audits for public companies to protect investors and maintain public trust in financial reporting. These audits adhere to stringent professional standards such as Generally Accepted Auditing Standards (GAAS) in the US and International Standards on Auditing (ISA) globally. These standards provide a structured framework for conducting audits, encompassing everything from planning and evidence gathering to reporting and quality control. The Public Company Accounting Oversight Board (PCAOB) further oversees the audits of public companies in the US, adding another layer of regulatory scrutiny. The rigor of these requirements ensures a high degree of reliability and consistency in external audit findings.

Internal audits, on the other hand, are generally voluntary, driven by internal management needs rather than external mandates. While not legally required in the same way as external audits, they are becoming increasingly prevalent as organizations recognize the value of proactive risk management and internal control assessments. Internal audits often follow frameworks and guidelines established by professional bodies like the Institute of Internal Auditors (IIA). The IIA Standards, for instance, offer a comprehensive framework for internal audit activity, emphasizing independence, objectivity, and a risk-based approach. While these guidelines provide structure and best practices, organizations have more flexibility in tailoring their internal audit approach to their specific needs and risk profile. For example, a smaller organization may focus its internal audit efforts on key operational processes, while a larger multinational corporation might employ a more complex, multi-layered approach incorporating specialized audit teams.

This difference in regulatory oversight results in varied compliance obligations, professional requirements, and stakeholder expectations for each type of audit. External auditors are accountable to external stakeholders, primarily investors and regulators, and their work focuses on providing assurance on the accuracy and fairness of financial statements. Internal auditors, however, primarily serve the organization’s management and board of directors, offering insights into operational efficiency, risk management, and internal controls. This internal focus allows for greater flexibility and customization in the scope and methodology of internal audits.

Pros and Cons of the Different Regulatory Landscapes:

External Audit:

- Pros: Legal compliance, standardized practices, professional accountability, enhanced stakeholder confidence.

- Cons: Rigid compliance requirements, potential for over-standardization, may not fully address specific organizational risks.

Internal Audit:

- Pros: Flexibility in approach, customizable standards, adaptive methodologies, tailored to organizational needs.

- Cons: Inconsistent practices across organizations, varying quality standards, potential for lack of independence if not properly structured.

Examples of Regulatory Impact:

- The SEC requires annual external audits for all publicly listed companies.

- Basel III banking regulations mandate specific internal audit requirements related to risk management and capital adequacy.

- SOX Section 404 requires external auditor attestation on the effectiveness of internal controls over financial reporting, highlighting the interplay between internal and external audit functions.

Tips for Navigating the Regulatory Landscape:

- Stay current: Regulatory requirements are constantly evolving. Stay informed about changes in auditing standards, legislation, and best practices to ensure ongoing compliance.

- Quality Assurance: Implement robust quality assurance programs for both internal and external audit functions to maintain high standards and address any deficiencies.

- Certification and Continuing Education: Ensure auditors maintain the required certifications (e.g., CPA for external auditors, CIA for internal auditors) and participate in continuing professional education to stay abreast of the latest developments in the field.

- Documentation: Thoroughly document compliance with applicable standards and regulations. This documentation provides evidence of adherence to best practices and facilitates regulatory reviews.

The distinct regulatory landscapes of internal and external audit underscore their unique roles within an organization. While external audits provide external stakeholders with assurance on financial reporting, internal audits offer valuable insights for internal management to enhance operations, manage risks, and strengthen internal controls. Understanding these differences is essential for leveraging both audit functions effectively to achieve organizational objectives and maintain good corporate governance. The interplay between these two functions, while distinct, contributes significantly to a robust control environment and strengthens stakeholder confidence.

This aspect of the "internal audit vs external audit" discussion is crucial for anyone involved in corporate governance, financial reporting, and risk management, making it a vital component of this comparative analysis.

4. Timing and Frequency Patterns

A key differentiator between internal and external audits lies in their timing and frequency patterns. Understanding these differences is crucial for organizations to effectively manage resources, minimize disruption, and maximize the value derived from both audit functions. This distinction impacts not only how audit teams operate but also how the business as a whole prepares for and responds to audit activities. When comparing internal audit vs external audit, timing and frequency are essential considerations.

Internal audits, focusing on ongoing operational efficiency and risk management, typically operate on a continuous, risk-based cycle. This means that internal audit activities occur throughout the year, with specific areas targeted based on a dynamic risk assessment. High-risk areas are audited more frequently, while lower-risk areas might be examined less often, perhaps following a rotational schedule. This flexible, adaptable approach allows internal audit to provide real-time insights and address emerging risks promptly.

External audits, on the other hand, primarily focus on verifying the accuracy of financial statements for stakeholders like investors and lenders. Therefore, they follow a more predictable, annual cycle aligned with the financial reporting calendar. These audits typically intensify towards the fiscal year-end, as auditors work to gather sufficient evidence to support their opinion on the financial statements. While some interim testing may occur throughout the year, the bulk of the external audit work is concentrated around the year-end closing process.

This difference in timing and frequency significantly influences several aspects of the audit process:

- Resource Allocation: Internal audit departments must maintain a consistent level of staffing throughout the year to support ongoing audit activities. External audit firms, however, often experience peaks and valleys in resource demands, requiring careful planning and staffing to manage the intense workload during the busy season.

- Business Disruption: The continuous nature of internal audits allows for more manageable, phased approaches, minimizing disruption to daily operations. External audits, with their concentrated year-end focus, can potentially create more significant, albeit temporary, disruptions during a period often already characterized by high pressure to finalize financial reports.

- Currency of Findings: Internal audit's continuous monitoring provides more timely identification of issues, enabling quicker remediation and reducing the potential impact of control weaknesses. External audit findings, while comprehensive, often relate to the prior fiscal year, meaning corrective actions may be implemented months after the identified issues occurred.

Different Interim vs. Year-End Testing Approaches: Internal audit employs ongoing testing throughout the year, allowing for adjustments to the audit plan based on emerging risks and changing business conditions. External audits utilize interim testing to gain an understanding of internal controls and test certain areas before year-end, but the primary focus remains on year-end procedures to substantiate the financial statements.

Varying Lead Times for Planning and Execution: Internal audit can initiate audits relatively quickly due to its flexible scheduling and readily available resources within the organization. External audits require more extensive planning and coordination with management, often involving longer lead times to schedule resources and align with the company's reporting timeline.

Examples of Successful Implementation:

- Amazon: As a massive, complex organization, Amazon conducts continuous internal audits across its various business units. This allows them to proactively manage risks related to e-commerce, cloud computing, logistics, and other operations.

- Deloitte's external audit of General Motors: Like most external audits of publicly traded companies, Deloitte's audit of General Motors intensifies during the fourth quarter, as they focus on verifying the accuracy of GM's year-end financial statements.

- Bank of America: Bank of America's internal audit department often implements a rotational cycle, ensuring all major areas are reviewed within a defined timeframe, for example, a three-year rotation cycle. This provides structured coverage while allowing for adjustments based on risk assessments.

Actionable Tips for Readers:

- Coordinate audit schedules: Collaboration between internal and external audit teams, as well as management, is crucial to minimize overlapping requests and reduce business disruption during peak periods.

- Implement continuous monitoring technologies: Leveraging data analytics and automation can enhance the effectiveness and efficiency of internal audit's continuous monitoring efforts.

- Plan external audit interim work strategically: External auditors can mitigate year-end pressure by strategically scheduling interim testing procedures throughout the year to spread the workload and identify potential issues early.

- Maintain audit calendars: Clear and accessible audit calendars, shared with relevant stakeholders, provide transparency and facilitate better planning and resource allocation.

By understanding the differing timing and frequency patterns of internal audit vs external audit, organizations can optimize the value and impact of both functions, ultimately contributing to improved governance, risk management, and operational efficiency.

5. Cost Structure and Resource Allocation

Cost considerations play a critical role in deciding between internal and external audits, and understanding the financial nuances is key to optimizing your audit function. This section of our "internal audit vs external audit" discussion delves into the distinct cost structures of each, enabling informed decision-making regarding resource allocation and budget planning. When comparing internal audit vs external audit, the cost structure and resource allocation differ significantly, impacting budget planning and overall audit effectiveness.

Internal audits represent a continuous investment, with ongoing operational expenses tied to salaries, benefits, training, continuing professional education, and the maintenance of internal audit infrastructure, including software and technology. These costs are relatively fixed and predictable, forming a consistent part of the organization's budget. Think of it as maintaining an in-house team, requiring a consistent outflow of resources regardless of the immediate audit workload. For example, IBM’s internal audit department reportedly incurs approximately $50 million in annual costs. This demonstrates the substantial investment large organizations make in maintaining a robust internal audit function.

External audits, on the other hand, operate under a different financial model. They are typically project-based, incurring professional service fees charged by external audit firms. These fees can fluctuate based on the complexity and scope of the audit engagement, the size and industry of the organization being audited, and the specific expertise required. This variable cost structure allows organizations to tailor their audit spending to their immediate needs. In 2022, Tesla paid $3.5 million to PwC for external audit services, showcasing the project-based nature of these costs.

The size and complexity of the organization also significantly influence the cost scaling of both internal and external audits. Larger, more complex organizations often require larger internal audit teams and more extensive external audit procedures, driving up costs in both areas. Conversely, smaller companies might find it more cost-effective to outsource their internal audit function altogether, thereby avoiding the fixed costs associated with maintaining an in-house team. This is a common practice, reducing the burden of fixed salaries and allowing access to audit expertise on an as-needed basis.

Technology and training investments also follow different patterns. Internal audit teams often require ongoing investment in audit management software, data analytics tools, and continuous professional development. These investments aim to enhance the team's efficiency, effectiveness, and ability to adapt to evolving audit standards and industry best practices. External audit firms typically embed these costs within their professional fees, leveraging economies of scale to provide access to cutting-edge technology and highly trained professionals.

Pros and Cons of Each Approach

Internal Audit:

- Pros: Predictable ongoing costs allow for easier budgeting. Retained organizational knowledge leads to deeper insights and efficiencies. Scalable resources can adapt to changing organizational needs.

- Cons: Fixed costs exist regardless of audit activity levels, potentially leading to underutilization. Limited specialized expertise might necessitate external support for specific audit areas.

External Audit:

- Pros: Variable costs based on specific needs provide flexibility and control over audit spending. Access to specialized expertise offers in-depth knowledge in niche areas. No ongoing overhead reduces fixed costs associated with permanent staff.

- Cons: High hourly rates can significantly increase costs for complex or extensive audits. Knowledge transfer issues can arise between engagements, potentially impacting audit continuity. Potential scope creep can lead to unforeseen cost overruns.

Actionable Tips for Optimizing Audit Costs:

- Benchmarking: Regularly benchmark your audit costs against industry standards to identify potential areas for improvement and ensure cost-effectiveness.

- Hybrid Models: Consider implementing hybrid models that combine internal resources with outsourced expertise for specific audit areas, optimizing cost and expertise utilization.

- Cost Tracking: Implement cost-per-audit-hour tracking to measure efficiency and identify areas where cost savings can be achieved.

- Contract Negotiation: Negotiate multi-year external audit contracts to secure more predictable pricing and potentially reduce overall costs.

- Explore Resources: Learn more about Cost Structure and Resource Allocation for a deeper dive into optimizing your audit budget.

By understanding the distinct cost structures of internal audit vs external audit, organizations can strategically allocate resources, optimize their audit function, and ensure that audit activities deliver maximum value. Whether you opt for an internal team, external support, or a hybrid approach, careful cost management is essential for achieving audit effectiveness and efficiency.

6. Stakeholder Communication and Reporting

A critical differentiator between internal and external audits lies in stakeholder communication and reporting. This aspect encompasses not just what information is conveyed, but also to whom, how, and why. Understanding these nuances is crucial for leveraging the full potential of both audit types. Internal and external audits cater to distinct audiences and, consequently, follow different reporting protocols, shaping the content, format, and distribution of their findings. This distinction significantly impacts how audit insights are utilized and the overall value they bring to an organization. Effectively managing these communication channels ensures that the right information reaches the right people in a format they can understand and act upon.

Internal audits primarily serve an organization's internal stakeholders, particularly management and the audit committee. These reports delve into the operational details of the business, providing specific recommendations for improvement across various functions. They often include sensitive information about internal processes, control weaknesses, and potential areas of risk. This level of detail enables management to make informed decisions regarding operational efficiency, risk management, and internal control optimization.

External audits, on the other hand, are geared towards external stakeholders such as investors, regulators, and the general public. Their primary objective is to provide independent assurance on the reliability of an organization's financial statements. External audit reports offer a standardized opinion, certifying whether the financial statements are presented fairly in accordance with generally accepted accounting principles (GAAP). This standardized format ensures consistency and comparability across different organizations, fostering trust and transparency in the financial markets.

Several key features distinguish internal and external audit reporting. Internal reports are characterized by detailed findings, specific recommendations, and a focus on operational improvements. External reports, conversely, prioritize standardized opinions and certifications, adhering to strict regulatory guidelines. Confidentiality is paramount for internal audit reports, as they often contain sensitive internal information. External reports, however, are public documents, subject to disclosure requirements. This difference in confidentiality dictates the level of detail and the type of information included in each report. Even the language used varies considerably. Internal reports may employ technical jargon specific to the industry or the organization, while external reports utilize standardized language to ensure broad understanding.

The distinct nature of internal and external audit reporting leads to unique pros and cons. Internal audits provide detailed, actionable insights and facilitate the sharing of confidential, sensitive information within the organization. However, their reach is limited to internal stakeholders, hindering broader communication. External audits, while offering standardized public assurance and essential regulatory compliance documentation, are constrained by standardized formats, which often limit the level of operational detail provided.

Numerous successful examples highlight the effective utilization of internal and external audit reporting. Berkshire Hathaway's internal audit reports, for instance, provide Warren Buffett with crucial insights into the operational performance of his diverse portfolio companies, informing his investment decisions. Externally, KPMG's audit opinion on Coca-Cola's financial statements offers investors the confidence they need to invest in the company. Audit committees play a vital role in bridging the gap between internal and external audits, integrating insights from both to provide a comprehensive view of the organization’s financial and operational health.

To maximize the effectiveness of audit reporting, consider the following tips: Tailor report language to the specific audience's expertise level, ensuring clarity and comprehension. Establish clear protocols for handling sensitive information within internal audit reports, maintaining confidentiality. Create executive summary formats for senior management, highlighting key findings and recommendations. Finally, implement tracking systems for audit recommendation follow-up, ensuring accountability and driving continuous improvement. Learn more about Stakeholder Communication and Reporting for insights into how AI-powered tools can enhance audit efficiency and reporting processes.

Understanding the key differences between internal and external audit reporting, including their respective stakeholders, objectives, and formats, is crucial for leveraging the full value of both audit functions. By effectively managing stakeholder communication and reporting, organizations can drive operational improvements, enhance financial transparency, and build stakeholder trust. This, in turn, contributes to stronger corporate governance, improved risk management, and ultimately, greater organizational success. This is why stakeholder communication and reporting is an indispensable element in any discussion of "internal audit vs external audit".

6-Point Internal vs External Audit Comparison

| Concept | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Independence and Objectivity Differences | Medium complexity: managing independence protocols and reporting lines | Moderate: internal staff vs. external fees | Balanced audit credibility; varying depth and perspective | Organizations needing both ongoing insight and external assurance | Internal: deep knowledge; External: complete objectivity |

| Scope and Purpose Variations | Medium: aligning diverse audit focuses | Moderate: broad internal scope vs. targeted external scope | Comprehensive operational insights vs. financial accuracy | Internal: risk and control improvement; External: financial validation | Internal: operational coverage; External: standardized verification |

| Regulatory Requirements and Standards | High: compliance with evolving professional and legal standards | High: certifications and ongoing education | Legal compliance, standardized methodologies, stakeholder confidence | Public companies and regulated entities | External: mandated rigor; Internal: adaptable methodologies |

| Timing and Frequency Patterns | Medium: coordinating continuous vs. cyclical audits | Moderate: ongoing vs. periodic resource allocation | Timely issue detection and comprehensive periodic review | Continuous risk management and annual financial reporting | Internal: real-time monitoring; External: predictable cycles |

| Cost Structure and Resource Allocation | Medium: balancing fixed internal costs and variable external fees | Variable: salaries and infrastructure vs. professional fees | Optimized budget allocation and resource planning | Budget-conscious organizations needing flexible resourcing | Internal: predictable costs; External: specialist access |

| Stakeholder Communication and Reporting | Medium: tailoring reports for different audiences | Moderate: detailed internal vs. formal external reporting | Clear, actionable internal insights and public assurance | Internal management decision-making and external stakeholder reporting | Internal: actionable detail; External: standardized assurance |

Strategically Integrating Internal and External Audits

Understanding the key differences between internal audit vs external audit is crucial for establishing a comprehensive and effective audit strategy. We've explored variations in independence and objectivity, scope and purpose, regulatory requirements, timing and frequency, cost structure, and stakeholder communication. By recognizing these distinctions, organizations can leverage the strengths of both internal and external audits to enhance governance, risk management, and overall operational efficiency. Mastering these concepts empowers businesses to proactively identify and mitigate risks, improve compliance, and foster a culture of continuous improvement.

Perhaps one of the most significant takeaways is the complementary nature of internal and external audits. While external audits provide an independent assessment of financial statements for stakeholders, internal audits offer ongoing monitoring and evaluation of internal controls and processes. This synergy creates a powerful framework for identifying vulnerabilities and strengthening organizational resilience. Effectively managing both functions allows for a more holistic approach to risk management and ensures alignment with strategic objectives.

From optimizing resource allocation and streamlining communication to enhancing compliance and improving decision-making, understanding the interplay of internal audit vs external audit offers significant advantages. Embracing a collaborative approach between these two functions is essential for building trust, transparency, and long-term organizational success.

Looking to streamline your audit workflows and enhance the effectiveness of both your internal and external audit processes? Explore the power of AI with Copilot Audit, an Excel add-in designed to improve accuracy, save time, and provide valuable insights. Visit Copilot Audit today to discover how this innovative tool can revolutionize your audit approach.